The Milliman Mortgage Default Index (MMDI) is a lifetime default rate estimate calculated at the loan level for a portfolio of single-family mortgages. For the purposes of this index, default is defined as a loan that becomes 180 days delinquent or worse.1 The results of the MMDI reflect the most recent data acquisition available from Freddie Mac, Fannie Mae, and Ginnie Mae, with measurement dates starting from January 1, 2014.

COVID-19 effects on mortgage risk

Interact with the MMDI

To explore the MMDI data on a more granular level, including loan origination and type, click here.

There is significant uncertainty around how mortgage performance may be impacted as a result of COVID-19. As of April 23, 2020, 26.4 million Americans have filed for unemployment benefits due to economic stressors from the coronavirus pandemic. As a result, we anticipate that the large number of unemployment claims will translate to an increase in mortgage delinquency rates. The economic and housing market slowdown resulting from the pandemic, in turn, could impact mortgage performance.

The models used in Milliman’s MMDI analysis rely upon home prices to forecast default rates; they do not rely on unemployment rates nor do they have specific adjustments for special forbearance programs such as those introduced in The Coronavirus Aid, Relief, and Economic Security (CARES) Act, which could result in an increase in forbearance and delinquency rates. Given this, the MMDI results for 2019 Q4 may underestimate the ultimate number of delinquencies that occur as a result of the COVID-19 pandemic. Adjustments have not been added to the models in response to COVID-19 because the models and index are designed to identify long-term trends on mortgage credit consistently across time. Further, the ultimate mortgage performance from delinquency to either cure or foreclosure / REO is uncertain. Historically, the transition rate from delinquency to claim has been driven by borrower equity. Given the robust home price growth experienced over the past several years, without sharp declines in future home prices, many delinquent borrowers are expected to cure from these delinquency events as they have equity in their properties. Milliman is actively monitoring and analyzing these trends to evaluate future mortgage performance in light of COVID-19.

Key findings: 2019 Q4

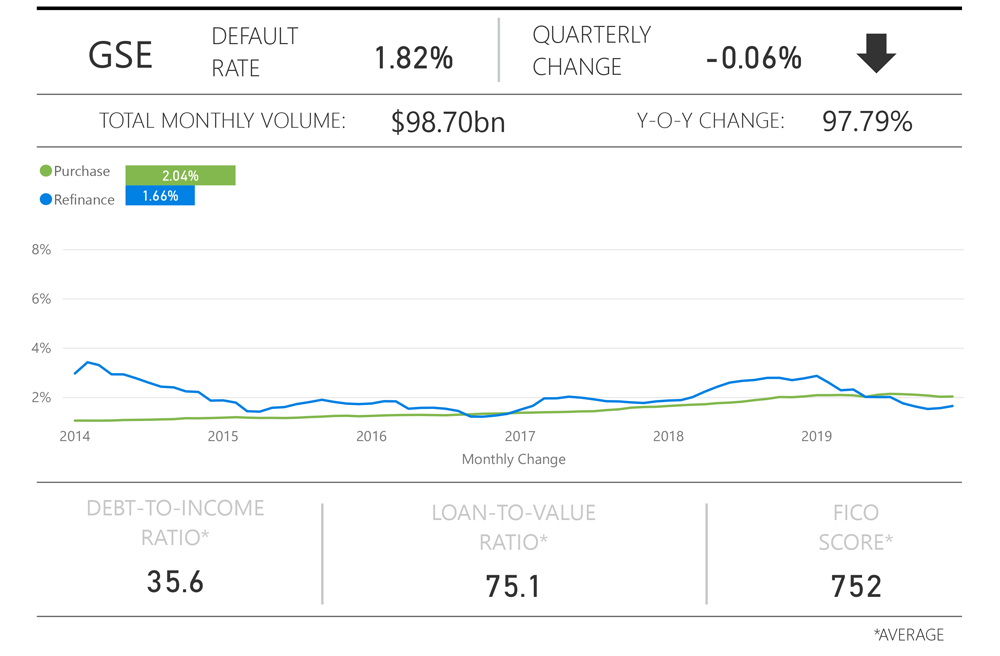

During the fourth quarter of 2019, the MMDI for government-sponsored enterprise (GSE) acquisitions (loans acquired by Freddie Mac and Fannie Mae) decreased, lowering from 1.88% in Q3 to 1.82% for loans originating in Q4. Figure 1 provides the quarter-end index results for these loans segmented by purchase and refinance. This quarter continues the trend of declining risk that persists from 2018 Q4 through 2019 Q4 primarily due to low-risk refinance borrowers once again taking advantage of the drop in interest rates.

The MMDI for Ginnie Mae loans increased from 8.26% in Q3 to 8.75% in Q4 as can be seen in Figure 2 (segmented by purchase and refinance). This increasing trend is consistent from prior origination quarters, as Ginnie Mae has experienced credit score drift relative to GSE acquisitions since 2014. It is important to note that for certain types of refinance loans Ginnie Mae acquisitions do not receive an updated credit score. In 2019 Q4, these loans accounted for approximately 8.5% of Ginnie Mae acquisitions. For the MMDI, a credit score of 600 is conservatively used to calculate the default risk on mortgages with a missing credit score.

When reviewing quarter-over-quarter changes in the MMDI, it is important to note that the 2019 Q3 MMDI values for GSE and Ginnie Mae acquisitions have been restated since our last publication, changing from 1.81% to 1.88% and 8.00% to 8.26%, respectively. This is a result of updating actual home price movements from forecasts and including updated forecasts for future home price appreciation. The forecast for home prices has been reduced to zero growth over the next several quarters in light of social distancing and anticipated lower purchase transaction volume in response to COVID-19.

The chart below summarizes default rates during the global financial crisis for a comparison of how rates look during an extreme scenario.

| Origination Quarter | Purchase | Refinance |

|---|---|---|

| 10/1/2007 | 1/1/2008 | 4/1/2008 |

| 16.76% | 14.25% | 13.01% |

| 11.52% | 8.64% | 9.17% |

Figure 1 shows a summary of the latest MMDI. Figure 1 is segmented by loan purpose and filtered to GSE loans.

FIGURE 1: MMDI DASHBOARD FOR GSE LOANS

Figure 2 shows a summary of the latest MMDI. Figure 2 is segmented by loan purpose and filtered to Ginnie loans.

FIGURE 2: MMDI DASHBOARD FOR GINNIE LOANS

Agency summary

During 2019 Q4, Freddie and Fannie acquisitions continued to have a decreased risk profile. As mortgage rates continued to decline, refinance mortgages made up approximately 60% of mortgage volume in the fourth quarter of the year. Refinance loans tend to have lower LTV ratios and lower risk relative to purchase loans. Note that these results do include upward pressure as a result of economic risk, which includes the projected impact of COVID-19. Our models estimate a slowdown in home price growth relative to prior years, which puts upward pressure on mortgage default risk. If actual home price growth differs from these projections, the MMDI will adjust accordingly in future publications.

Loans guaranteed by Ginnie Mae experienced an increase in their default risk in 2019 Q4, driven mainly by increased economic uncertainty. Of the Ginnie Mae loans originated during this time period, 66% were purchase loans. For the remaining refinance loans, many were originated through streamlined refinance programs, where a credit score is not provided. These loans are conservatively assigned a credit score of 600 in the index, which increases borrower default risk during heavy refinance periods for FHA and VA.

Components of default risk

The components of the MMDI that inform default risk are borrower risk, underwriting risk, and economic risk. Borrower risk measures the risk of the loan defaulting due to borrower credit quality, initial equity position, and debt-to-income ratio. Underwriting risk measures the risk of the loan defaulting due to mortgage product features such as amortization type, occupancy status, and others. Economic risk measures the risk of the loan defaulting due to historical and forecasted economic conditions.

Borrower risk results: 2019 Q4

With the exception of Ginnie Refinance loans, borrower risk decreased across all investor and loan types during 2019 Q4. With the decline in interest rates, we observed an increase in rate/term refinance originations. As borrowers refinance, they tend to do so at lower loan-to-value (LTV) ratios (with a cash-out refinance now being capped at 80% across all agencies), which reduces the credit risk of the underlying mortgages.

Underwriting risk results: 2019 Q4

Underwriting risk represents additional risk adjustments for property and loan characteristics such as occupancy status, amortization type, documentation types, loan term, and others. Underwriting risk after the global financial crisis remains low and is negative for purchase mortgages, which were generally full documentation, fully amortizing loans. In 2019 Q4, we have seen an increase in the percentage of refinance loans that are rate/term. This loan type has a lower risk profile relative to cash-out refinance mortgages.

Economic risk results: 2019 Q4

Economic risk is measured by looking at historic and forecasted home prices. Actual home price appreciation has been robust from 2014 through 2019, which has resulted in embedded appreciation for older originations. This results in reduced credit risk for older cohorts. For more recent cohorts, we have observed and continue to anticipate slower home price growth (or negative growth for some local geographies), which contributes to increases in economic risk for recent origination years. These trends may be increased as a result of the COVID-19 pandemic. Relative to the last quarterly release of the MMDI, this edition of the index forecasts zero to negative home price growth for the majority of states. Please read the COVID-19 section for more context on economic risk.

About the Milliman Mortgage Default Index

Milliman is an expert in analyzing complex data and building econometric models that are transparent, intuitive, and informative. We have used our expertise to assist multiple clients in developing econometric models for evaluating mortgage risk both at point of sale and for seasoned mortgages.

The Milliman Mortgage Default Index (MMDI) uses econometric modeling to develop a dynamic model that is used by clients in multiple ways including analyzing, monitoring, and ranking the credit quality of new production, allocating servicing sources, and developing underwriting guidelines and pricing. Because the MMDI produces a lifetime default rate estimate at the loan-level, it is used by clients as a benchmarking tool in origination and servicing. The MMDI is constructed by combining three important components of mortgage risk: borrower credit quality, underwriting characteristics of the mortgage, and the economic environment presented to the mortgage. The MMDI uses a robust dataset of over 30 million mortgage loans, which is updated frequently to ensure it maintains the highest level of accuracy.

Milliman is one of the largest independent consulting firms in the world and has pioneered strategies, tools, and solutions worldwide. We are recognized leaders in the markets we serve. Milliman insight reaches across global boundaries, offering specialized consulting services in mortgage banking, employee benefits, healthcare, life insurance and financial services, and property and casualty insurance. Within these, Milliman consultants serve a wide range of current and emerging markets. Clients know they can depend on us as industry experts, trusted advisers, and creative problem-solvers.

1For example, if the MMDI is 10%, then we expect 10% of the mortgages originated in that month to have become 180 days delinquent or worse over its lifetime