The rise of collateralized reinsurance and what it means for the future of insurance-linked securities.

A number of institutional investors and asset managers have begun to invest in hedge funds specializing in securitized catastrophe insurance risk. This influx of new reinsurance capital has recently driven down yields on catastrophe bonds and other insurance-linked securities (ILS), causing these catastrophe-focused hedge funds to broaden their portfolios in search of new sources of yield.

As a result, today’s catastrophe-focused hedge funds often invest heavily in privately structured reinsurance deals called collateralized reinsurance. These deals offer the potential for large returns—while also adding layers of risk and complexity more commonly associated with the portfolios of reinsurers. How can investors and catastrophe-focused hedge funds ensure that they are properly pricing and valuing collateralized reinsurance investments?

Compare and contrast: Hedge funds versus reinsurers

Until around 2013, the market for alternative reinsurance capital could be viewed as a growing competition between the “old guard” of traditional reinsurers and the “new challengers” of hedge funds. There are important contrasts between the two sides, including:

- Fundamentally different models for the source and cost of capital (equity-backed reinsurers versus fixed-income securitizations)

- Distinct ways of supporting the promise to pay future claims (reinsurer credit ratings versus full collateralization)

- Different forms of risk transfer instrument (reinsurance contracts versus financial securities such as catastrophe bonds)

The dominant investments for catastrophe-focused hedge funds were catastrophe bonds and industry loss warranties (ILWs). Both of these, particularly when written on an index1 instead of indemnity basis2 , could be viewed as de facto derivative plays on catastrophe risk. Even the key market terminology (e.g., catastrophe bond “coupons” and “principal”) came from finance, not insurance. As a result, most catastrophe-focused hedge funds could be viewed as a slightly exotic variant on a standard theme for alternative asset managers.

Paradigm shift: Hedge funds and collateralized reinsurance

In the last two years, this dynamic has fundamentally changed. While the volume of catastrophe bonds and ILWs has grown, the majority of new capital entering the market has been deployed in the form of collateralized reinsurance.

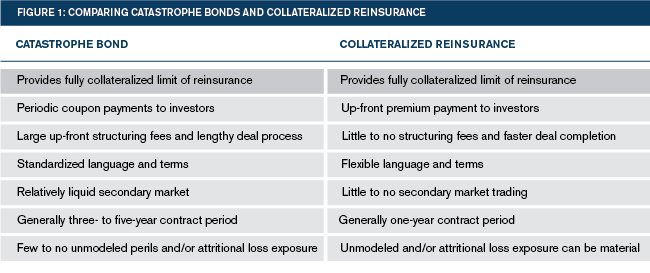

Collateralized reinsurance and catastrophe bonds share one key characteristic: both provide a fully secured limit of insurance to the ceding (re)insurer. Otherwise, they are starkly different.

What factors have driven catastrophe-focused hedge funds to significantly increase their collateralized reinsurance writings? Supply and demand: The supply of catastrophe bonds coming to market has been outpaced by the rising volume of investor capital looking to invest in these assets. While the amount of catastrophe bond principal outstanding increased by US$4.1 billion during 20133 , the amount of assets under management of the top 10 catastrophe-focused hedge funds increased by almost twice that, or US$8.0 billion.4

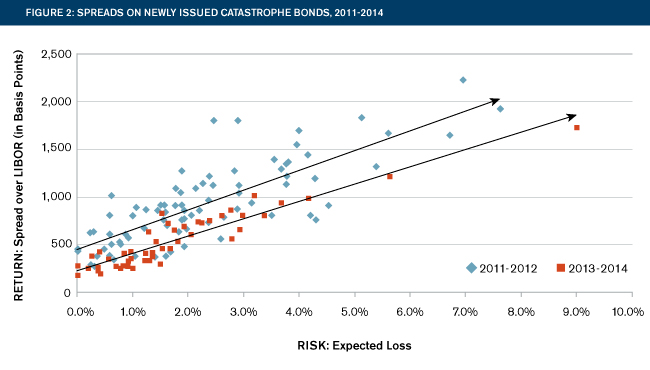

In turn, this supply imbalance has contributed to a reduction in catastrophe bond yield spreads. Funds have to take on far more risk5 on newly issued deals in the current market to make the same returns on catastrophe bonds that they received as recently as 2011.

Facing declining yields on catastrophe bonds and needing to deploy large amounts of capital, catastrophe-focused hedge funds have often turned to collateralized reinsurance. The customizable nature of collateralized reinsurance creates a number of opportunities—and risks—that are largely absent from catastrophe bonds, including:

- The flexibility for ceding (re)insurers to shape the contract to more closely match their capital and risk management needs

- The ability to insure against losses that aren’t typically covered in catastrophe models (e.g., marine or aviation losses), which provide diversification benefits and may offer higher returns that are due to their “unmodeled” nature

- The opportunity for smaller deals that do not fit the catastrophe bond model, which is due to high fixed structuring costs

For the informed investor, collateralized reinsurance is a jack-of-all-trades instrument that allows funds to actively grow and shape their portfolios instead of having to wait for the next catastrophe bond to reach market. Need to take greater risks and increase yield? Diversify a portfolio by adding new geographies and/or perils? Build a relationship with a particular (re)insurer with a strong track record? For each of these situations, collateralized reinsurance has become a primary solution for specialist hedge funds.

Hedge fund, or reinsurer?

When a fund makes a sizeable investment in collateralized reinsurance, it increasingly begins to resemble a reinsurer. Tradable securities are replaced by illiquid reinsurance contracts, and the fund can accumulate exposure to a number of “unmodeled” risks that would largely be absent from portfolios focused on catastrophe bonds.

As a result, the divide between catastrophe-focused hedge funds and reinsurers is rapidly disappearing. This transition has at least two important implications that should be fully understood by catastrophe-focused hedge funds and their investors.

First, investing in collateralized reinsurance requires new expertise. The term “unmodeled” risk is a misnomer; even if not captured by major vendor catastrophe models, firms must find some way to analyze these exposures to determine a contract price. Investors must also understand customizable and often complex reinsurance contract terms, including but not limited to:

- The scope of covered exposures and losses—by peril and region

- Contract attachment points, retentions, sub-limits, exclusions, and drop-down provisions

- Reinstatement provisions

- Inuring reinsurance

- Collateral maintenance and drawdown requirements

Second, the recent increase in illiquid holdings of collateralized reinsurance may lead to additional levels of regulatory scrutiny. The U.S. Securities and Exchange Commission (SEC) has recently stepped up scrutiny of the valuation of illiquid assets to protect investors and to safeguard against improper incentives for fund managers. In a recent Financial Times article, a senior ILS professional reported that several managers in London had been recently visited by the SEC.6 It is reasonable to expect further attention as the asset class continues to grow and mature.

The importance of actuarial insight

The proper use of actuarial expertise is key to successful collateralized reinsurance investing. Actuaries, who have long held central positions at reinsurers, are becoming increasingly relevant in the ILS space as funds begin to look increasingly like de facto reinsurers. Actuaries interpret catastrophe model results and can provide substitute modeling when no catastrophe models are available. The use of actuarial techniques is necessary to analyze the past profitability of major reinsurance quota shares. Furthermore, actuaries can provide independent reviews where no liquid secondary market or easy “mark-to-model” valuation exists.

The leading catastrophe-focused hedge funds were generally founded by leading reinsurance professionals and maintain an impressive array of internal modeling experts. These funds may still find it worthwhile to obtain an independent actuarial valuation of their portfolios. Not only does this provide an important review of the internal valuation practices of the fund, but it may also provide additional comfort to investors and the SEC that the investments are being valued on a consistent and fair basis.

A similar level of diligence is needed by the institutional investors making allocations to these hedge funds, or considering allocations in the near future. The additional illiquidity and complexity of collateralized reinsurance add to the valuation challenges. Investors who view collateralized reinsurance as just another form of ILS without understanding the extent of the differences are likely to underperform and put the long-term success of their portfolios at risk.

Looking forward

Catastrophe-focused hedge funds face further pressure on their portfolio returns over the next several years—as expiring bonds continue to be replaced by lower-yielding renewals. It follows that the role of collateralized reinsurance will continue to grow. The inherent flexibility of collateralized reinsurance will allow funds to pursue deals that would be difficult or impossible to structure as a catastrophe bond. For funds and investors alike, the enhanced returns made possible by these custom-tailored deals will have to be evaluated in consideration of risk presented by their illiquidity and complexity.

For institutional investors interested in ILS, the rise of collateralized reinsurance introduces new wrinkles into the due diligence and monitoring processes. The ability to deliver excess ILS returns in the market is now largely dependent on a fund’s ability to source and manage private reinsurance deals. In this way, catastrophe-focused hedge funds will provide a large portion of reinsurance capital in the coming years.

1I.e., tied to an industry, modeled, or parametric trigger.

2I.e., tied to the losses of the individual cedant.

3As per industry news website Artemis.bm.

4As per industry news website Trading Risk.

5In Figure 2, degree of risk is measured by rising “expected loss.”

6Johnson, Steve (August 31, 2014). European fund houses fear SEC’s reach. Financial Times. Retrieved October 18, 2014, from http://www.ft.com/cms/s/0/45e9d028-2ebe-11e4-bffa-00144feabdc0.html#axzz3CHHKEQ6q (requires registration).