This article was originally published in October 2014. It was updated in January 2017 to reflect nomenclature change. Thanks go to Jessica Gardner, Scott Preppernau, and Frank Thoen for these updates.

Retirement risks

A Milliman Sustainable Income Plan™ (SIP) can help alleviate participants' concerns about:

- Managing their own money

- Outliving their assets

- Losing benefit value to inflation

A SIP can address employers' concerns about:

- Funding (contribution) volatility

- Accounting (balance sheet) volatility

- Variable rate Pension Benefit Guaranty Corporation (PBGC) premiums

It is risky, promising retirement security in a future we can’t predict. In recent decades, we have seen an enormous amount of volatility in investment markets, we have seen bond yields fall to historic lows, and we have seen people continue to live longer than previous generations. What’s coming next? We don’t know.

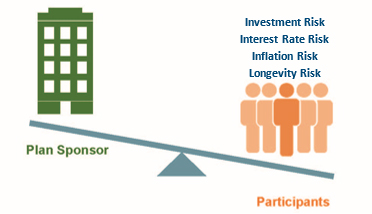

What we do know is that retirement risks are timeless. There are four main risks associated with saving and paying for retirement benefits. They are:

In a defined contribution (DC) plan, all of these risks are borne by the participants. In a traditional defined benefit (DB) plan, all of these risks (except inflation) are borne by the employer. In a SIP, these risks are shared in a way that makes for a more secure and sustainable retirement plan alternative for both employers and participants.

In any retirement plan retirement benefits are funded through contributions and investment earnings on those contributions. Investment risk is the risk that assets do not perform as well as expected.

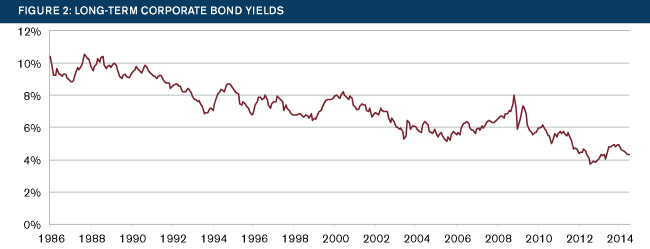

Figure 1 shows a series of red squares representing the annual returns from 1926 to 2013 of a portfolio invested 70% in the S&P 500 and 30% in long bonds.1 The green line shows a typical expected investment return assumption of 7%. Major down markets are shaded in blue. They include the market crash of 1929, which actually lasted for four years and led to the Great Depression, the market crash of 1973-1974, the dot-com bubble of the early 2000s, and the housing bubble/financial crisis of 2008.

Big market events occur more often than standard models predict they should; for example, we have experienced four 100-year floods in the last 90 years. And these events can be very difficult for both employers and employees to manage.

In DB plans, investment unpredictability leads to volatile contribution and accounting requirements that are very difficult for employers to manage. In DC plans, investment losses are similarly difficult for participants to manage as they may be forced to increase contributions, delay retirement, or lower their standards of living in retirement.

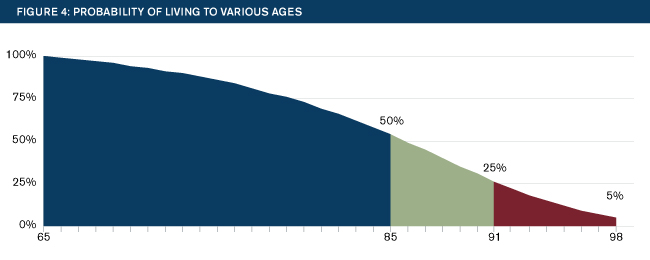

Interest rate risk is the risk that interest rates will change, resulting in price changes on bond-type instruments.

Figure 2 shows the yield on long-term corporate bonds over time. We are currently in an environment where bond yields are very low, which makes bond purchases expensive. This means that borrowers pay low interest rates and savers get small returns (on bonds). For instance, mortgage rates are very low right now (good for borrowers) but certificates of deposit (CDs) are getting very little return (not so good for savers). The opposite was true in the 1970s; mortgage rates were double-digit but typical bank savings accounts offered good interest rates.

Low interest rates make annuity purchases and bond investments expensive. This causes difficulties for retirees looking to decrease the risk in their DC plan benefit. Similarly, DB plan sponsors face increased costs as low interest rates inflate liability values and make immunizing retiree benefits expensive.

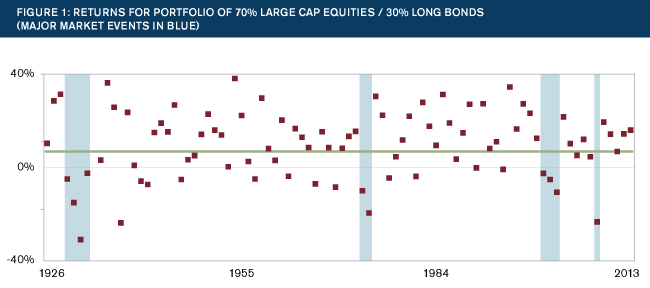

Inflation risk is the risk that prices will increase over time, decreasing purchasing power.

Over the past 86 years, inflation has averaged 3% per year. If a retiree had a fixed $1,000 benefit at retirement and inflation was 3% each year, after 30 years of retirement the purchasing power of that benefit would be reduced to $412. On average, goods and services would cost over twice as much, but the retiree would still only receive $1,000 a month.

Both DB and DC plan participants face the threat of a decreased standard of living in retirement caused by inflation eroding their purchasing power. While some DB plans offer inflation protection through cost-of-living adjustments, this plan provision has become less common. DC plan participants can plan their spending to allow for future inflation. Or they can adjust their investment mix to help keep pace with inflation, but this often comes at the cost of additional investment and interest rate risk.

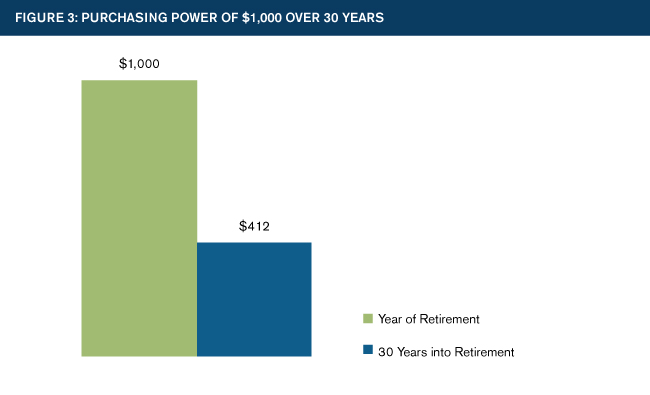

Longevity risk is the risk associated with not knowing how long you will live.

Figure 4 shows the probability of a 65-year-old living to various ages.2 For instance, there is a 50% chance that a 65-year-old will live past age 85. There is a 25% chance a 65-year-old will live past age 91 and a 5% change a 65-year-old will live past age 98.

When individuals face longevity risk alone, as in a DC plan, the large variance in life expectancy makes retirement planning very difficult. A person can spend his assets assuming he will live to life expectancy (about age 85), but then has a 50% chance of outliving his assets. If he wants more security, he can spend his assets assuming he will live to age 98 and have only a 5% chance of outliving his assets. However, he will have a much lower standard of living. In fact, there would be a 95% chance that he had money left over when he died that could have been used to enjoy a higher standard of living in retirement.

While it is very difficult to predict the life expectancy of one individual, the average life expectancy of a large group of people is quite predictable. In a DB plan, longevity risk is pooled among all the participants and the plan provides benefits based on the average life expectancy of the group. This maximizes the benefit provided for each dollar of contribution.

DC plan risk balance

In a DC plan, the employer makes a fixed contribution, typically tied to pay, and the obligation goes no further. This leaves the participants to manage their exposures to all four major retirement risks alone.

Figure 5: DC Plans

Investment risk in a portfolio can lead to large asset swings from year to year. Large decreases can impact a DC plan participant’s ability to retire or utilize their savings as planned. In addition, nearly all DC plans require participants to direct the investments in their individual account assets. Most people do not have the time, interest, and skill required to determine their best allocations over time. Indeed, on average, professional investment management adds 1% to the expected return.3 This can result in DC participants having 10% to 20% lower assets in retirement than if their asset allocation had been overseen professionally.

Managing investment risk can be especially difficult in retirement because ongoing withdrawals make it harder to weather investment losses, which jeopardizes a participant’s ability to sustain lifelong income.

Longevity risk is very difficult for individuals to manage. DC plan participants must either spend conservatively (and have a lower standard of living) to make their savings last until a very old age or run the risk of running out of assets in old age.

Inflation is likewise difficult to plan for. DC plan participants can address future inflation by planning for increasing (rather than level) withdrawals in retirement, but this results in a lower standard of living in retirement. Alternatively, they can adjust their investment mixes to help keep pace with inflation, but this could result in either lower expected returns (if purchasing inflation-protected securities) or increased investment risk (if investing more aggressively). Most often, people’s standard of living declines as they age.

Participants who want to eliminate investment risk, longevity risk, or even inflation risk by purchasing an annuity subject themselves to interest rate risk. This is acceptable if interest rates are high and they can get a good value, but if interest rates are very low, annuity purchases will be quite expensive.

While DC plans provide stable contribution and accounting requirements for employers, the individual DC risks that are all borne by the participants add up to a significant risk of inadequate retirement income. If the same contribution is made to a DC plan and a DB plan, the DB plan is expected to provide a larger benefit because investments are professionally managed, longevity risk is pooled, and participants are not subject to interest rate risk. All of these factors may be contributing to the change in recent years in employee preference away from DC plans and toward DB plans.4

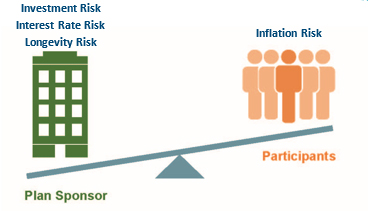

Traditional DB plan risk balance

Figure 6: DB Plans

In a traditional DB plan, the employer generally takes on all the retirement risks other than inflation protection. A DB plan provides a secure retirement benefit that is paid over the participant’s lifetime (assuming no lump sums). It can also be paid in a form that covers not just the participant’s lifetime, but a spouse’s lifetime as well.

DB plans pool longevity risk. As described earlier, this allows them to maximize benefits for a given level of contributions while providing lifelong income to all participants. Longevity risk is relatively easy for an employer to bear because the experience is spread across a large population. Although the mortality table used to project longevity may need to be updated periodically, the associated losses from people living longer are small compared to the investment and interest rate risks faced by traditional DB plans. Additionally, these losses can be mitigated or eliminated by planning for future increases in life expectancy.

The major drawback of traditional DB plans is the very large contribution volatility that employers experience over time. This is a direct result of investment risk and interest rate risk and the impact of plan maturity.

Plan maturity has made required pension contributions much more volatile. Plan maturity occurs when plan assets become large compared to contributions. This typically occurs when there are large retiree liabilities compared to active liabilities. A market downturn reduces all plan assets, but the burden of re-funding liabilities falls only on the current actives and/or the current company.

When a pension plan is new there are no assets. In the early years, a plan can sustain investment losses because assets are small and contributions are large. Mature plans, though, have large asset pools. The dollar value of a 10% market loss may dwarf the typical contribution level, causing funding difficulties.

Many more plans are mature today than in the past. This has made weathering recent downturns much more difficult than downturns in the past when these same plans were younger and had fewer assets to lose, fewer retirees to support, and comparatively higher contributions.

Investment risk can lead to large changes in asset values from year to year. Over the past 15 years, we have experienced two major market downturns. Asset declines associated with these downturns have resulted in increased contribution requirements, which are especially difficult for mature plans (see sidebar).

Under the Pension Protection Act of 2006 (PPA) funding rules and US GAAP accounting standards, both asset and liability measures are volatile for traditional DB plans. Asset smoothing is allowed only over short periods and liabilities change every year with the current interest rates.

Additionally, interest rate risk makes managing retiree liability more difficult. Employers may want to reduce retiree liability through immunization, dedication, or annuity purchase in an effort to “de-risk” their plans. When interest rates are relatively low (as they have been for quite some time) de-risking can be an expensive solution.

DB plans generally provide participants with significantly more security than DC plans because the employer has taken on the investment, interest rate, and longevity risks. While longevity risk is relatively easy for employers to bear, their exposure to investment and interest rate risks are so onerous that many employers have terminated their DB plans. The percentage of private sector employees covered by DB plans has declined from 38% to 14% over the past 30 years.5

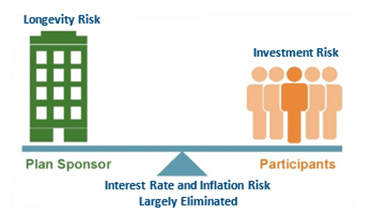

SIP risk balance

It is clear we need an alternative. Ideally, this alternative should eliminate as many retirement risks as possible. The risks that cannot be eliminated should be minimized, and borne by the entities best able to bear them.

Figure 7: SIPs

Milliman Sustainable Income Plans™ (SIPs) are just such an alternative.

Under a SIP, all benefits for actives and retirees adjust with actual plan investment returns. This places the investment risk on the employees, similar to a DC plan. This is appropriate because investment risk is very unpredictable and does not become more predictable through pooling. In fact, pooling of investment risk can actually increase the risk to the employer as the plan matures (see above). This makes it very difficult for plan sponsors to bear investment risk while still providing a meaningful benefit.

Although employees bear the risk, investments in a SIP will be professionally managed as in a traditional DB plan. Professional management results in higher expected returns and lower expected expenses, which ultimately provide participants higher expected benefits than they'd receive from individually managed DC accounts. Because benefits increase with investment returns, some inflation protection is expected over time. The longevity risk is retained within the plan where it is most effectively managed, as with DB plans.

Because SIP benefits adjust based on plan asset returns, assets and liabilities remain in balance regardless of a plan’s investment performance. This has the effect of eliminating the interest rate volatility that has plagued traditional DB plans. And, because a SIP pays benefits as an annuity for the life of the employee (and spouse if elected), employees are not exposed to interest rate risk either. For details see SIPs: Predictable Contributions and Accounting.

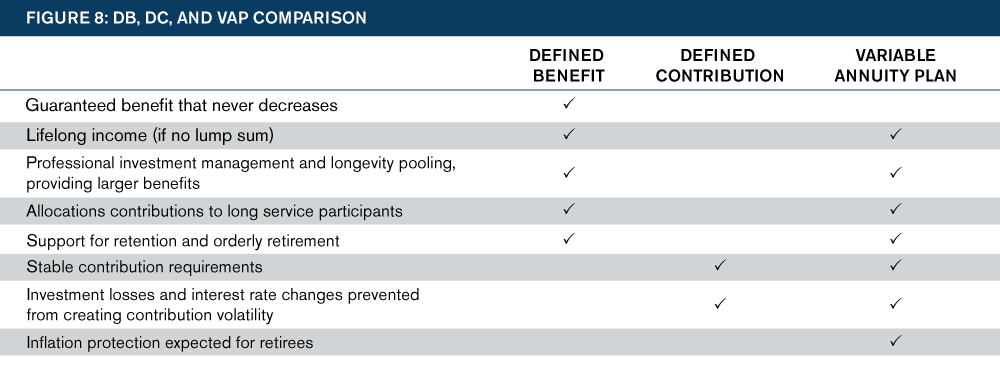

SIP strengths

The table below provides a comparison of major features of the DB, DC and SIP designs.

A SIP combines many of the strengths from traditional DB and traditional DC plans. As in a DB plan, a SIP provides maximum benefits for a given level of contributions by pooling longevity risk and having professionally managed assets. Additionally, a SIP provides lifelong income to retirees. Although the level of the benefit may change over time, employees know that they will have income for their lifetimes (and the lifetimes of their spouses, if elected).

Because the employer is isolated from market risks in a SIP, the contributions are predictable, as with a DC plan, and the balance sheet impact is much more stable.

Also similar to a DC plan, employees retain the investment risk. This, however, means they also enjoy the market upside potential and expected long-term growth in the benefit, which is due to investment returns helping to provide inflation protection.

Unlike traditional DB plans, which generally pay a fixed benefit for the life of the retiree, benefits under a SIP have the potential to decrease in the event of market downturns. To minimize the likelihood of this occurring, SIPs have benefit stabilization strategies that significantly help manage this volatility.

Because SIPs are not yet common, employees, plan sponsors, and plan advisors may not be familiar with their specific issues, and it may take time to become comfortable with the design.

A SIP can help address employee concerns with retirement security by providing lifelong income with some expected inflation protection, while eliminating employer concerns about funding and balance sheet volatility. SIPs provide a retirement plan designed to better balance the risks between employee and employer and provide sustainable retirement security.

For details on how the plan works, see Strengths of a variable plan design.

For details on how to minimize the effect of investment risk on participants, see SIP Benefits.

1 2014 Ibbotson SSBI Classic Yearbook. 70% Large Company Stocks: Total Return Index and 30% Long-Term Corporate Bonds: Total Return Index.

2 Based on 2014 417(e)(3) applicable mortality table.

3 Towers Watson Insider (December 2009). Defined Benefit vs. 401(k) Investment Returns: The 2006-2008 Update.

4 Nyce, S. (March 2012). Attraction and retention: What employees value most. Towers Watson Insider.

5 Employee Benefit Research Institute (2014). FAQs About Benefits—Retirement Issues: What Are the Trends in U.S. Retirement Plans?.