This article was originally published in October 2014. It was updated in January 2017 to reflect nomenclature change. Thanks go to Jessica Gardner, Scott Preppernau, and Frank Thoen for these updates.

Measuring pension obligations

For both funding and accounting purposes, pension plans are required to measure the value of earned benefits and compare that value to plan assets. While the requirements for these two purposes are slightly different, the way in which the value of benefits is measured is the same. Actuaries project the benefit payments that the plan is expected to pay to each participant each year in the future, based on benefits earned prior to the measurement date. These payments are then discounted back to the measurement date based on an assumed interest rate. The resulting value is referred to as a plan’s funding target (for funding purposes), accumulated benefit obligation (for FASB Topic 715), or the present value of accrued benefits (for FASB Topic 960). For purposes of this article, we will use the generic term “accrued liability” to refer to the present value of a plan’s benefits that have been accrued as of the measurement date.

One of the key aspects of a Milliman Sustainable Income Plan™ (SIP) is the predictability of both the Pension Protection Act of 2006 (PPA) funding requirements and the Financial Accounting Standards Board (FASB) accounting items. This predictability is achieved by the way in which the benefits adjust based on the investment return of the assets backing the liabilities.

Accrued liability

When determining a plan’s accrued liability (see sidebar), the plan’s expected future benefit payments are discounted to the measurement date based on an assumed interest rate. The accrued liability represents the amount of money needed on the measurement date that would be sufficient to pay all future benefit payments (based on benefits earned to date) if assets earn the assumed interest rate each year. For example, if an employer has a pension plan that will be making a single payment of $10,000 one year from today and the assumed interest rate is 5%, $9,524 is needed today to make the $10,000 payment at the end of the year ($10,000 = $9,524 x [100% + 5%]).

In many situations, actuaries use the expected investment return on plan assets when determining the assumed interest rate that is used to develop a plan’s accrued liability.

Forward rates vs. spot rates

Yield curves are comprised of a series of “spot rates” that are the expected yields on zero-coupon bonds at periodic maturities. Each spot rate is the amount an investor expects to earn on his money annually between today and the future date. For example, a spot rate of 4.5% at Year 4 means that investors expect to earn 4.5% annually from now until Year 4. A spot rate of 5.5% at Year 5 means that investors expect to earn 5.5% annually from now until Year 5.

If these two points lie on the same yield curve, there is an implied forward rate that links the two spot rates. The forward rate is the interim rate of return that needs to be earned between two points on the yield curve so that each spot rate is achieved. In the example above, consider an investor who invests $100 and will be paid back when the bond matures at Year 4. The investor earns 4.5% annually and expects to be paid back $119 in Year 4 ($100 x 104.5% x 104.5% x 104.5% x 104.5%). If the same investor had the opportunity to invest $100 for five years at 5.5% (as suggested by the yield curve) that investor would receive $131 at Year 5. To be indifferent between the two investments, an investor must expect to be able to reinvest the $119 from the four-year bond and earn enough in the next year to produce the same value at the end of Year 5 as the five-year bond. The forward rate from Year 4 to Year 5 is the rate at which this can be achieved. In this example the rate is 10.1% ($119 x 110.1% = $131).

For example, FASB Accounting Standards Codification (ASC) Topic 960 measurements, PPA and funding measurements for multiemployer plans, and public plan funding liabilities are all determined using assumed interest rates based on the plan’s expected investment return. However, for some measurements, actuaries must use interest rate assumptions that are mandated by laws or regulations. For example, single- and multiple-employer plans must determine accrued liability for both funding and accounting purposes using assumed interest rates that are based on the yields of high-quality fixed income investments (bonds). In other words, even though most pension plan portfolios are not invested 100% in bonds, the regulations require that actuaries adopt these assumptions for the future return on plan assets when determining the accrued liability for these purposes.

SIPs and future investment returns

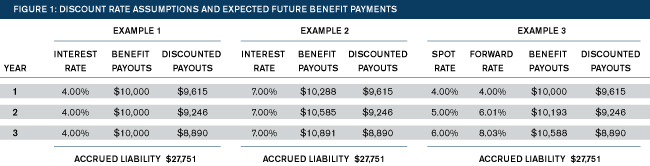

Because a SIP automatically adjusts the benefits of the plan based on the actual return on plan assets, an expectation for future benefit changes must be incorporated into the calculations when determining a plan’s accrued liability. As a simple example, imagine a 4% hurdle rate SIP with only one participant who is currently receiving $10,000 per year. If the assumed interest rate used to determine liability is 7%, then the benefit payments are assumed to increase by approximately 2.9% each year, (100% + 7%) / (104%) = 102.9%. The future payouts are expected to be $10,288 at the end of the first year, $10,585 at the end of the second year, etc. Those future benefit payments are then discounted back at 7% per year to determine the accrued liability. Mathematically, this is equivalent to assuming flat benefit payments of $10,000 and discounting at 4% per year (see Figure 1).

Similarly, if prescribed interest rates are used to determine a plan’s accrued liability, the benefits are assumed to adjust based on those rates. When a yield curve has been prescribed for use, the forward rates implicit in that yield curve become the expected future returns for purposes of determining expected future benefit payments.

Figure 1 shows how the selection of the discount rate assumption affects the expected future benefit payments but does not affect the SIP’s accrued liability.

For all examples above, the hurdle rate for the SIP is 4%. Benefits are payable at the end of the year and are initially $10,000.

In Example 1, the assumed interest rate is equal to the hurdle rate. The benefits payable in future years do not change because the assumed return on the assets equals the hurdle rate. To determine the accrued liability, each future benefit payment is discounted to the beginning of Year 1 (the measurement date). The benefit payment due at the end of Year 1 is discounted by 4% ($10,000 / 104%), the benefit payment in Year 2 is discounted by 8.2% ($10,000 / 104% / 104%), and the benefit in Year 3 is discounted by 12.5% (three years at 4% compounded annually). The sum of the discounted payouts is the accrued liability of $27,751.

Example 2 is very similar to Example 1 except that the assumed interest rate is 7% in all future years. Because the assumed interest rate is different than the hurdle rate, the benefit payable in future years changes based on the formula described in SIP Basics, (1 + I) / (1 + H) - 1. In this example, the benefits increase by 2.9% each year. When those increased benefit payments are discounted back using the 7% assumption, the accrued liability is $27,751—the same as Example 1 where we assumed no benefit growth and a 4% discount rate.

Example 3 represents a simplified yield curve. For this example, the spot rates on the yield curve are assumed to be 4% for Time 1, 5% for Time 2, and 6% for Time 3. The forward rates implied by the hypothetical yield curve (see sidebar) are 4% during Year 1, 6.01% during Year 2, and 8.03% during Year 3. The benefits payable at the end of each of those years are then adjusted assuming that the plan assets earned that return for the year. For example, in Year 1 the forward rate was 4% so there was no adjustment to the benefit payments because the hurdle rate is also 4%. In Year 2, the forward rate is 6.01% so the benefit increases by about 1.9% (106.01% / 104%). In Year 3, the benefit increases by approximately 3.8%, which is due to the assumed 8.03% return. When these projected benefit payments are discounted back using the spot rates from the yield curve—remember, the spot rates are used to discount that year’s payment all the way back to the starting point—the accrued liability is again $27,751.

As the examples above show, regardless of the assumed interest rate, the accrued liability under a SIP will be the same. Any variation in the assumed interest rate implies a change in the expected benefit payments. The effect is that the liabilities can be valued at the hurdle rate for all purposes, making them insensitive to changes in the assumed interest rate and eliminating interest rate risk for the plan.

There is another way to think about this. Consider that all investment increases and decreases immediately create a corresponding increase or decrease in the liabilities (a gain on assets will increase benefits, which in turn increases the liability, and vice versa). This results in no change to the plan’s funded status. The accrued liability of the SIP is not affected by the investment return assumption selected. If a high-return assumption is selected, then the benefits are expected to increase based on that assumption and are discounted at the higher rate. If a lower asset return assumption is selected, then the benefits are assumed to increase at a slower rate and to be discounted at the lower rate. The liability is the same in both cases. In other words, the economic reality is that a SIP’s accrued liability is not impacted by the assumed interest rate.

Investment risk

In addition to eliminating interest rate risk as demonstrated above, SIPs also insulate the plan sponsor from investment risk. When the asset performance is below the hurdle rate, the underlying SIP benefits automatically decrease to account for the underperformance. Consider a SIP with a 4% hurdle rate that is 100% funded at the beginning of the plan year and has $100,000 in assets and liabilities. During the year, the assets return 7%. At the end of the year, the assets have increased to $107,000 (assume no cash flows for simplicity). The liabilities were expected to increase by 4%. Remember that the hurdle rate is the effective assumed interest rate and the plan is one year closer to paying benefits. The expected end-of-year liability is $104,000. However, because the plan assets earned 7% the benefits (and hence the liabilities) are adjusted by a factor of (107% / 104%). The adjusted end-of-year liability is now $107,000 = $104,000 x (107% / 104%).The plan’s funded status is still 100% at year-end because the assets and liabilities are equal.

Consider now a year where the asset return was -5%. The end-of-year assets are $95,000 = $100,000 x (100% - 5%). As before, the expected end-of-year liability is $104,000. However, because the actual asset return was -5%, the liability is adjusted by a factor of (100% - 5%) / 104%. The adjusted end-of-year liability is $95,000 = $104,000 x (100% - 5%) / 104%.

In both cases, the plan’s funded status was not affected by the asset return for the year and remained 100% funded. It should be noted that, under a SIP, the plan may be over 100% funded, holding a reserve to prevent benefits from declining. Under a SIP, payments to prevent retiree benefit declines will only be made when there is sufficient reserve so the plan stays at least 100% funded even when the benefits payable to retirees are being preserved at the high-water mark.

Funding stability

By eliminating interest rate and investment risk, SIPs alleviate much of the concern that plan sponsors have with traditional DB plans. Under a traditional DB design, interest rate and investment risk combine to create volatility both in funding requirements and financial reporting.

Under the PPA, when a plan is underfunded, the plan sponsor is required to make additional contributions to fund the difference between the assets and the liabilities. This so-called shortfall is required to be paid based on a seven-year amortization schedule. The amount of the shortfall payments can be highly leveraged for large plans as even small percentage changes in the asset or liability values can create significant contribution requirements. This is particularly a concern for very mature plans where the size of the inactive liability has become large compared to the size of the company. As long as a plan stays at least 100% funded, maturity is not a concern. However, in a traditional defined benefit (DB) plan, changes in the discount rate or asset underperformance can cause sudden, significant underfunding which can be very difficult for sponsors of mature DB plans to endure.

In a variable annuity plan (VAP), maturity is not a concern because the inactive (and active) liability stays funded in all market conditions. While a VAP will stay well-funded, it will not “pay for itself” during periods of market outperformance. This means that, similar to a defined contribution (DC) plan, there will be stability in contribution requirements, but there will not be contribution holidays. Because the benefits will increase with asset returns above the hurdle rate, any asset outperformance creates benefit increases and not overfunding. Similarly, asset returns below the hurdle rate create benefit decreases and not funding shortfalls. Asset performance is one of the primary drivers of funding instability in traditional DB plans, but a VAP design eliminates this instability by passing the plan’s investment performance directly on to the participants. A SIP, which builds on and improves the VAP design, mitigates the effect on participants when investment returns underperform, while still maintaining a fully funded status.

In a SIP, returns over a specified threshold are not credited for purposes of increasing the benefit. Instead, the excess return builds a reserve that would be used to prevent benefits from dropping during down markets. When sufficiently large, the reserve could be used to increase overall benefit levels. It also has the potential to allow short-term contribution holidays, but a long-term holiday would undermine the reserve’s ability to protect benefits from declining. Each year, the cost of the benefits accruing should be funded to ensure that the plan stays healthy. Sponsors should also consider funding a small reserve for demographic gains and losses, asset return timing mismatches, etc.

Accounting stability

From an accounting perspective, the balance sheet impact of the SIP is much more stable from year to year than a traditional DB plan because the primary sources of balance sheet volatility are eliminated in a SIP:

- In a traditional DB plan, a plan’s investment performance can create significant overfunding or underfunding of the plan’s liabilities. In a SIP, investment performance is reflected in the plan’s liabilities (i.e., benefits are adjusted to reflect investment performance), which eliminates this source of volatility.

- In a traditional DB plan, changes in the interest rates required to determine the plan’s liability can cause large swings in a plan’s funded status. In a SIP, a plan’s liability is not sensitive to the assumed interest rate used to determine the liability, which eliminates this source of volatility.

Because of certain FASB calculation requirements, a SIP can actually be slightly underfunded on a plan sponsor’s balance sheet (see sidebar for more detail). However, the level of underfunding should be modest and is not expected to be volatile from year to year.

The pension expense under a SIP will also be much more predictable than under a traditional DB plan. The key components of pension expense are service cost, amortization of outstanding gains/losses, interest cost, and expected return on assets. In a SIP, the service cost will work the same as a traditional DB plan. The value of the benefits accruing during the year will need to be recognized as an expense in the year they are earned.

PBO for pay-related plans

Under FASB accounting requirements, all DB plans that are pay-related, including career average plans, are required to reflect projected salary in the projected benefit obligation (PBO), which is the measurement upon which a plan sponsor’s annual accounting expense and balance sheet liability is based. A SIP stays fully funded on an accrued liability basis (accrued liability is referred to as accrued benefit obligation, or ABO, under FASB rules), but will not necessarily remain fully funded on a PBO basis because of the required treatment of assumed future salary increases.

As a result, there is some potential for underfunding of the SIP on a plan sponsor’s balance sheet. However, the volatility of this underfunding is significantly reduced in a SIP because the liability under a SIP is insensitive to changes in the assumed interest rate that must be used to measure a plan’s liability. In other words, while a SIP may be slightly underfunded on a plan sponsor’s balance sheet because of the peculiarities of FASB measurement requirements, the plan’s funded position is expected to be stable from year to year.

The amortization of outstanding gains or losses is one of the most difficult expense components to predict. In a traditional DB plan, changes in the interest rates or losses in asset value can create large swings in the outstanding gain or loss. Under a SIP, the interest rate risk is no longer a factor and the investment performance is mirrored in the liability value. This greatly reduces the volatility of plan gains and losses. There will still be some gains and losses, which are due to demographic experience being different than assumed, but they should be small in comparison to the size of the plan.

Due to the way liabilities automatically adjust for asset performance, the interest cost and expected return on assets will largely be offsetting. Interest cost is the expected change in liabilities during the fiscal year before accounting for additional benefit accruals. In a SIP, this change includes any asset performance different than the hurdle rate. Because of this, there is a link between interest cost and expected return on assets. If the expected return on assets is set higher than the hurdle rate, expected growth in assets is offset by expected growth in liabilities. The main reasons these two expense entries might not match is that the PBO exceeds the ABO or the plan has built a funding reserve (see SIPs Stabilize Benefits).

Because of their unique design, SIPs greatly reduce pension expense volatility and balance sheet volatility. By minimizing gains and losses, and through the offsetting nature of interest cost and expected return on assets, SIPs have much more predictable pension expense as the service cost becomes the only driving factor for expense.

Conclusion

By eliminating the major risks associated with sponsoring a DB plan, a SIP design provides a stable alternative to the volatility of traditional DB plan funding and accounting requirements. Current DB plan sponsors who would like to reduce the risks associated with providing retirement benefits should seriously consider a SIP design. Additionally, companies that would like to provide lifelong retirement income for their employees, but are unable to justify taking on the risks associated with a traditional DB plan, should also consider a SIP design. For more information on transition to a SIP, see SIP Transition.