Retirement is a risky business whether for a plan sponsor navigating the volatile contribution requirements of a traditional defined benefit pension plan or an employee trying to determine the right retirement date to avoid outliving a 401(k) balance. The retirement benefit is an important component of the benefits package, but most retirement plans are falling short.

The changing retirement landscape

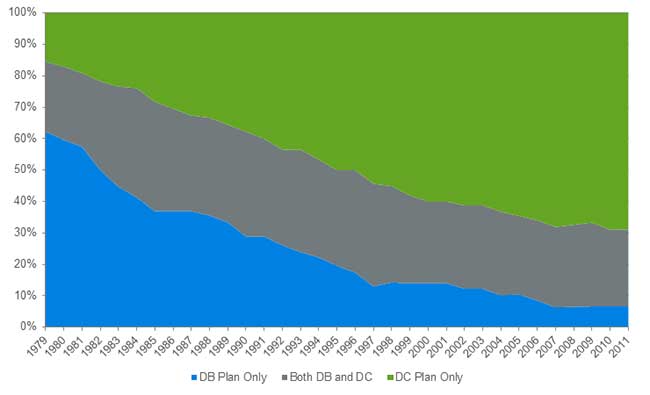

Over the past 40 years, the primary retirement plan offered by most employers has transitioned from traditional defined benefit (DB) plans, which provide participants with a guaranteed monthly annuity for life, to defined contribution (DC) plans, which provide participants with self-directed investments to accumulate savings for retirement. The chart in Figure 1 shows that, of participants with a retirement plan, the number with a DB plan decreased from 84% to 31% between 1979 and 2011.1

Figure 1: Private-sector participants in an employment-based retirement plan by plan type

While the reasons for this shift are discussed below, the negative consequences are becoming evident as the first generation of DC-only participants begins to retire.

Traditional defined benefit plans

Traditional DB plans provide the following important benefits to employers’ business operations:

- Help attract and retain talented employees. DB plans are an attractive feature for prospective employees, particularly since the poor returns of the 2000s, and DB plans generally provide a strong incentive to remain with an employer.

- Help workforce management. A well-designed DB plan provides not only the means for employees to retire, but also offers signals and incentives for desired retirement timing. With lifelong income provided, retirees do not need to be concerned with outliving their retirement assets, and so are less apt to delay retirement.

- Most efficient design for turning a dollar of contribution into retirement benefits. DB plans create larger benefits than DC plans per dollar contributed. This is due to inefficient asset allocation decisions by participants, generally higher investment fees (particularly postretirement), and the difficulty of planning for uncertain life expectancy on an individual basis. In total, this results in about 30% less retirement income than the same contribution could have bought through a DB plan.2

However, traditional DB plans have largely failed at providing employers stable and predictable funding requirements and accounting results. As the size of the plan grows, so does the volatility and the contributions required to deal with any asset underperformance or the impact of low interest rates. These aspects of DB plans are challenging from a business perspective—a retirement plan’s funding should not be so volatile as to endanger the viability of the employer’s business.

Defined contribution plans

What the traditional DB plan does poorly, the DC plan does extremely well. Employers make stable, predictable contributions to participants’ retirement. Instead of resulting in additional employer contributions, poor investment experience simply reduces benefits (i.e., DC account balances decrease), which effectively transfers investment risk from the sponsor to participants.

However, DC plans struggle to replicate the positive benefit characteristics of DB plans:

- DC plans generally do not have features that incentivize retention.

- A DC plan requires the participant to show discipline and restraint in order to accumulate enough funds to retire. Experience shows that this behavior is the exception rather than the norm. Despite employer efforts at education and innovations such as auto-enrollment and auto-escalation, participants often undermine their own retirement security by:

- Not deferring enough of their income to meet their retirement needs

- Making poor investment allocation decisions

- Cashing out their account balances before retirement

- Retirement from a DC plan is heavily reliant on unpredictable market returns. Participants will retire when they feel they have enough money and not before. As a result, participant retirements are correlated with market performance, which is unlikely to align with an employer’s strategic objectives.

- DC participants rarely convert their account balances to annuities to ensure lifelong income, leaving them susceptible to outliving their resources in retirement. Those that do annuitize their balances may find this a very expensive proposition in certain market conditions.

First generation of DC-only retirees is struggling

The effectiveness of DC plans varies by individual. Financially savvy employees with discretionary income tend to do well, while employees without discretionary income or financial knowledge often struggle to ensure themselves a secure retirement through DC plans. As a result, the replacement of lifelong DB income with DC savings has left millions at risk of outliving their resources. This is borne out by the following statistics:

- “Rates of poverty among older households without DB pension income were nine times higher than for households with DB pension income.”3

- Older Americans are filing for bankruptcy at rates 200% of what they were 25 years ago.4

- According to the Government Accountability Office (GAO), the median DC balance for households aged 55 to 64 with retirement accounts was only $104,000, an amount that would be enough to lock in an insured, inflation-protected annuity of only about $310 per month if the owner purchased an annuity with the balance.5

- Only 6% of DC participants protect themselves against outliving their money by purchasing an annuity.6

The evidence indicates that the shift from DB plans to DC plans is making a dignified and poverty-free retirement less certain than ever before, and has been a major factor in the current retirement crisis in the United States. A retirement system that is based primarily on individually managed accounts can, and almost certainly will at some point, result in a significant portion of the nation’s elderly population outliving their resources. Such a situation would have negative economic consequences for all stakeholders (participants, employers, and society as a whole) that are hard to overstate.

Case studies

Whether you offer a DB plan or a DC plan, there are options available to help manage the risks you and your employees face. Here are four case studies, one on an alternative plan design that is worth a look for both DB and DC sponsors and three on ways of managing DB plan risks.

Revisiting plan design: New alternatives provide a better risk balance

If we were to design a new retirement plan from scratch that works for both employers and their employees, the result would be a hybrid of the traditional defined benefit (DB) and defined contribution (DC) plans with the following characteristics:

- Stable and predictable funding and accounting requirements: Employers cannot underwrite a guarantee on future investment performance. Investment performance cannot cause wide swings in contribution and accounting requirements, which means benefit amounts must adjust to asset performance, like in a DC plan.

- No intergenerational risk transfer: One generation of employees should not have its retirement security sacrificed for another generation of employees. When a DB plan becomes underfunded, employers either increase contributions or decrease future benefits. This means that current employees assume some of the risk for all previous employees. To eliminate this risk, the plan design must avoid underfunding in all market conditions, which again means benefits that adjust based on asset performance.

- Provide lifelong income. The risk associated with unknown life expectancy is very difficult for an individual to efficiently manage. One of the primary reasons that DB plans are able to provide participants with secure retirements is that “longevity risk” is pooled, allowing the plan to efficiently provide lifelong benefits for all participants. To provide this attractive feature, the plan design must pool longevity risk.

- Support workforce management. The plan design should aid attraction and retention of top talent and facilitate predictable retirement, similar to a DB plan.

- Maximize retirement benefits for contributions made. In addition to longevity pooling, the DB plan characteristics of professional asset management and lower investment expenses lead to a plan that is more efficient at converting contributions to benefits. This feature helps maximize benefits per contribution dollar.

- Protect retiree purchasing power. Inflation is one of the greatest risks to retirement security faced by retirees as they age.

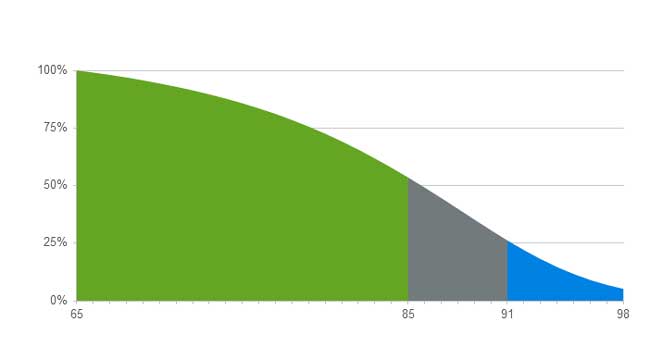

The longevity challenge: A 65-year-old individual will live on average about 20 more years. If this individual draws down their retirement savings over 20 years, he or she will have a 50% chance of dying before running out of money and a 50% chance of outliving the money. Reducing this risk means a lower standard of living (i.e., spending less money each year to spread it out over more years). The individual should plan to live about 26 years and spend 11% less each year to reduce the chance of outliving the assets to 25%, or about 33 years spending 18% less each year to reduce the chance of outliving assets to 5%.7

Figure 2: Probability of a 65-year-old living to old age

The result of this uncertainty is that individuals must balance their immediate desires for a higher standard of living with the potential outcome of outliving their resources. Pooling longevity risk, on the other hand, allows each individual to experience a standard of living based on the average life expectancy of the group without a risk of outliving their benefits.

Sustainable Income Plan

The Milliman Sustainable Income Plan® (SIP) incorporates all of the above desirable retirement plan features, providing lifelong income with a stable and predictable cost. Made legal under 2014 hybrid regulations, 15 sponsors have transitioned their DB plans to SIPs and a few DC sponsors are exploring starting SIPs as companions to their DC plans. There are other alternative designs possible under the 2014 regulations, but this is the design many sponsors are choosing, though sponsors should consider a wide variety of solutions before choosing one.

The Milliman SIP is a retirement plan that provides contribution and accounting stability, while also providing employees meaningful, lifelong, inflation-protected income. By sharing the risks of retirement between employees and employers in a more rational way than either traditional DB plans or DC plans, the SIP design provides an opportunity for employers to significantly improve the results they see from their benefits packages.

How SIPs work

SIPs are DB plans with benefits that adjust to reflect the investment experience of the plan’s assets. The benefit earned each year is determined by a formula as a monthly benefit payable at retirement, like in a traditional DB plan. While the employer has significant flexibility in the structure of the benefit accrual formula, the plan’s benefit level is set based on a conservative investment return, called a “hurdle rate.” If the plan’s investment returns exactly match the hurdle rate, the plan would function just like a traditional DB plan. However, unlike a traditional DB plan, if investments do not match the hurdle rate, benefits adjust up or down (generally annually) to reflect the plan’s experience. This mechanism allows the plan to remain well funded in all market conditions like a DC plan.

Avoiding benefit decreases in a SIP

The SIP design as described above will result in retirement benefits that are always well funded and cannot be outlived, but may have a high amount of volatility. Employers have expressed concern about the potential for benefit decreases in a SIP, particularly for retirees. Most retirement plan participants in the United States are currently covered by DC plans where this potential benefit decrease exists as well. However, the SIP design addresses this concern, taking advantage of recent Internal Revenue Service (IRS) hybrid plan regulations that allow stabilization features limiting benefit volatility.

The SIP uses a simple and effective method to significantly reduce the possibility of benefit decreases. The SIP undertakes a savings strategy on behalf of plan participants by establishing a stabilization reserve (or a “rainy day fund”) that is tapped to keep retiree benefits from decreasing with poor investment performance. The reserve can be funded in different ways.

A common method is to set part of the plan’s investment gains aside in particularly good years. This slows the growth of benefits in exchange for benefit stability in retirement.

A well-designed SIP is unlikely to experience benefit decreases. However, in the unlikely event that investments do poorly enough to completely deplete the stabilization reserve, benefits would decrease. Even in this case, though, there would be no increase in contribution requirements, no intergenerational risk transfer, and no chance for participants to outlive their benefits. In other words, even in this situation, the outcome is preferable to the likely outcome of either a traditional DB plan or a DC plan.

Conclusion

Traditional DB plans are no longer the predominant form of retirement plan because, as they grew in size, they became unsustainable and jeopardized the business viability of employers. Their replacements, DC plans, provided the stable contribution and accounting requirements that traditional DB plans could not provide, but have largely failed to support the human resource objectives of employers or to provide rank-and-file participants with retirement security.

SIPs provide the most logical hybrid solution by combining the best features of DB plans with the best features of DC plans in a plan design that is completely sustainable. SIPs do a superior job of meeting the needs of both employers and plan participants compared to either traditional DB or DC plans.

- For employers, SIPs provide larger retirement benefits for the same contribution dollars and contribution stability as in a DC plan, while helping to meet human resource objectives.

- For participants, SIPs provide lifelong income with expected inflation protection, which dramatically reduces the chance of poverty in old age relative to a DC plan.

SIPs align financial and human resource objectives, while providing participants with the best possible chance at secure retirements free from poverty. It can be a standalone design that provides lifelong income or used in combination with a DC plan to encourage participant savings. For DC-only sponsors who add a SIP, it is a way to increase tax-advantaged savings, especially for highly compensated participants.

Retirement plans are long-term in nature, and retaining the current status quo means many participants will continue to earn benefits and ultimately retire from plans that leave them highly susceptible to poverty in old age. The sooner changes are made, the sooner both employers and plan participants can reap the benefits.

For more information, visit milliman.com/sips or contact [email protected].

Asset liability matching: Coaxing assets and liabilities to align

Historically, defined benefit (DB) plan assets were volatile while the funding liabilities were relatively stable. This resulted in some contribution and balance sheet volatility. However, changes enacted in the Pension Protection Act of 2006 amplified volatility by requiring that funding liabilities be calculated based on corporate bond rates. These rates change over time, sometimes substantially. This amplifies the overall plan funding volatility because both the assets and liabilities are now market-based.8

Some plans are implementing asset liability management (ALM) to reduce both investment risk and interest rate risk through a more tactical asset allocation. The goal of ALM is to alleviate some of the volatility without completely sacrificing expected investment returns. ALM stabilizes the balance sheet by having a portion of the assets and liabilities move together (i.e., increase or decrease in like values as a reaction to changing market conditions).

In order to develop a holistic asset liability strategy, it is important to understand the impact of asset allocation on projected funded status and contribution requirements. Generally, strategies with greater stability have higher contribution requirements. Pension liabilities behave in much the same way as bonds, but sponsors typically have their DB assets invested in balanced portfolios of stocks and bonds. Because stocks are expected to experience higher returns over time than bonds, a portfolio invested more heavily in bonds will require more contribution support but will have less volatility.

It is advisable to study asset liability strategies using stochastic forecasts comparing a variety of possible asset allocation strategies, while taking into account analysis of possible Pension Benefit Guaranty Corporation (PBGC) variable rate premiums, the probability of benefit restrictions, and expected changes to segment rates under the law. Ultimately, asset allocation strategies will be developed based on a plan sponsor’s financial goals and objectives, balancing the ability to accept risk against the ability to make larger contributions to the plan.

An optimized solution

One such client had the objective of optimizing growth in its DB plan’s assets while minimizing the risk of large losses. The client decided to implement a “glide path” investment approach where, as the funded status of the plan improves, the asset allocation is rebalanced by shifting more from stocks to bonds. Thus, the DB plan is moving to a more de-risked position as it becomes better funded. Because discount rates and assets can shift significantly from day to day, the client wanted to be able to make investment decisions on a daily basis, based on the daily funded status of its DB plan. This allows immediate reactions to changes in funded status and helps lock in any gains that may be seen.

The Milliman Daily Pension Tracker was built to assist this client in its strategic de-risking. The tool is a fully automated model that pulls in market indices, develops a unique yield curve of interest rates, calculates the liabilities of a DB plan, and pulls in asset information directly from the bank, all on a daily basis. The model automatically generates emails, texts, and website updates with real-time market information regarding the liability and funded status of a DB plan.

A “glide path” approach with the Milliman Daily Pension Tracker helped our client make investment reallocations at opportune times during the market business cycle. Going forward, the client is able to take a more proactive approach to managing the funded status of its DB plan, thus accomplishing the goal of optimizing growth while gradually de-risking.

For more information, visit https://www.milliman.com/en/products/milliman-daily-pension-tracker or contact a Milliman consultant.

Liability defeasance: Annuity purchase or lump sum offering

As defined benefit (DB) plans mature, their liabilities can grow large in relationship to the size of the company. The volatility of the required contributions, expense, and balance sheet can get in the way of the needs of running the business. A future downturn that dramatically decreases the plan’s Internal Revenue Service (IRS) and Pension Benefit Guaranty Corporation (PBGC) funding ratios could lead to untenable contribution requirements.

Annuity purchase

One way to decrease the plan size is to purchase annuities from qualified insurance companies. This is typically done for retiree benefits only, as the annuity cost for terminated vested participants, whose retirement date is unknown, may be unreasonably high. The price of the annuities purchased is generally larger than the release of liability on an accounting or funding basis, but the reduction in the size of the plan reduces the impact future market returns can have on the sponsor.

The change in contribution requirements, including PBGC premiums and accounting impact, are outlined below. These options are not designed to reduce cost in the near term, but to manage risks for the long term.

Contribution requirement and PBGC premium impact

In the current interest rate environment, the purchase of annuities typically increases a plan’s unfunded liabilities, resulting in a short-term increase in annual required contributions because the cost of the annuity purchase is likely greater than the release of liability. This is especially true for plans that are over 100% funded as they may move from not having an annual contribution requirement to having one. Any funding shortfall must be paid off over roughly seven years. The annuity purchase decreases the participant count used to determine the PBGC flat-rate premium and the variable-rate premium cap, which lowers premiums. However, if the plan is not 100% funded, any increase in unfunded liability generally causes a net increase in the PBGC premium until the plan is funded. In the long term, the annual required contributions and PBGC premiums should be more stable and less costly after the annuity purchase. Most importantly, the plan is less sensitive to market returns because the size of the plan is smaller, which reduces the impact of all retirement risks relative to the company size.

Accounting impact

Purchasing annuities typically results in increased expense and a one-time settlement. However, the long-term effect of the annuity purchase is reduced balance sheet volatility relative to the company size and a more stable annual expense recognition because of the reduced exposure to market and demographic risks.

Lump-sum offering

Offering lump sums to terminated vested participants may have short- and long-term effects very similar to those seen when purchasing annuities. Unlike an annuity purchase, where the cost and liability release is known in advance, in a lump-sum window , participants must elect to draw their benefits. The dependence upon participants’ elections makes the size of the reduction, and therefore the impact of the offering, difficult to predict.

Though the election rate of lump sums may be hard to predict, lump-sum offerings are generally cheaper than annuity purchases. Current market interest rates used to calculate the lump sums are generally higher than what an insurance company will use to determine the cost of the purchased annuity. There is also no expense or profit load on the lump sum as there will be with an annuity purchase. Other potential beneficial outcomes are decrease in plan size, less exposure to risk moving forward, and lower PBGC premiums. There could be an incentive to offer lump sums to terminated vested participants before they retire, though the offer could affect the cost of an eventual annuity purchase for those who remain in the plan.

Instead of receiving stable income from an annuity, either through a retirement plan or an insurance company, participants who elect lump sums must bear the burden of carefully managing their assets so that they do not outlive their resources.

For more information, visit milliman.com or contact a Milliman consultant.

Plan freeze: A permanent reduction in risk

Over the past 40 years, many employers have transitioned away from providing retirement benefits under traditional defined benefit (DB) plans. This move is generally due to the plan’s accounting expense and contribution requirements being too volatile and Pension Benefit Guaranty Corporation (PBGC) premiums being too expensive. If the sponsor’s competitors are offering defined contribution (DC) plans, there may not be enough competitive advantage to warrant the increased volatility of retaining the DB plan. Because retirement plans are an important benefit in attraction and retention, replacement plans are nearly always put in place, and they are typically DC plans. However, hybrid regulations from 2014 provide for new alternatives that should also be considered (see Revisiting plan design: New alternatives provide a better risk balance).

Nevertheless, if a decision is ultimately made to depart from the DB structure, there are two ways to freeze a DB plan. One is to retain the DB plan for current employees and have new employees participate in a replacement plan. This is sometimes called a “soft freeze” or closing a plan. This will reduce volatility and may reduce costs, depending on the replacement plan, but only over time. It also results in employees doing comparable work, but being compensated differently. In order for the sponsor to achieve the benefits of a freeze more quickly, accruals in the DB plan can be completely frozen for all participants, providing all future retirement benefits in the successor plan. This is a “hard freeze.”

The effects of a hard freeze on contribution and accounting results are outlined below.

Contribution requirement and PBGC premium impact

A hard freeze has no impact on funding or PBGC liabilities, so there will be no immediate change to PBGC premiums. But the elimination of new participants will help keep PBGC premiums lower over the long run. Additionally, the elimination of future accruals should allow the company to significantly reduce annual contributions to the DB plan. The plan sponsor remains liable for payment to cover any current or future unfunded liabilities.

A hard freeze has no impact on funding or PBGC liabilities, so there will be no immediate change to PBGC premiums. But the elimination of new participants will help keep PBGC premiums lower over the long run. Additionally, the elimination of future accruals should allow the company to significantly reduce annual contributions to the DB plan. The plan sponsor remains liable for payment to cover any current or future unfunded liabilities.

While the DB plan cost may be reduced, the combined cost of the legacy DB plan and the new DC plan could be higher or lower than the cost of continuing the DB plan. The cost is dependent upon the generosity of the DC plan benefits and the level of underfunding in the DB plan.

Accounting impact

The hard freeze will constitute a curtailment for accounting purposes and may require the recognition of certain deferred costs under U.S. GAAP. For pay-related plans, a hard freeze will reduce the projected benefit obligation (PBO) because salaries are no longer projected to increase in the future. This liability reduction constitutes a curtailment gain for accounting purposes and could be recognized immediately if it exceeds the required recognition of deferred costs, including any unrecognized losses. Because interest rates are currently very low, most plans are not funded on an accounting basis and likely have large unrecognized net losses, which would preclude any immediate gain recognition from the curtailment. The freeze eliminates the service cost (the value of benefits accruing), reduces the interest cost proportionate to the reduction in PBO, and may reduce the amortization of unrecognized net losses. The overall impact is a reduction in the expense. Keep in mind that this reduction is offset by the added cost of contributions to the successor plan.

Other considerations

For many years, the company may have two plans to maintain, administer, and communicate, which increases some operational costs.

The impact on employees is often reduced benefits, though not always. Depending on the replacement plan, future retirees may have less income security. In a DC plan, this may lead to employees remaining employed longer than they would have otherwise, especially after a market downturn. The cost of delayed retirement can be very large, as productivity may decrease, healthcare costs may rise, and retention of younger workers may be more difficult if they cannot see a path to advancement.

For more information, visit milliman.com or contact a Milliman consultant.

Caveats

The materials in this article and the linked case studies represent the opinion of the authors and are not representative of the views of Milliman, Inc. Milliman does not certify the information nor does it guarantee the accuracy and completeness of such information. Use of such information is voluntary and should not be relied upon unless an independent review of its accuracy and completeness has been performed. Materials may not be reproduced without the express consent of Milliman.

1Employee Benefit Research Institute, 2015. Accessed September 10, 2016. FAQS About Benefits- Retirement Issues.

2Assuming annual returns of 7% in a DB plan and 6% in a DC plan, spending DC balance to maintain income until age 98, and life expectancy of age 85 at age 65.

3National Institute on Retirement Security. The Pension Factor 2012: The Role of Defined Benefit Pensions in Reducing Elder Economic Hardships, p. 1.

4New York Times (August 5, 2018). ’Too little too late’: Bankruptcy booms among older Americans. The article summarizes data from the Federal Reserve’s survey of consumer finances, via the Consumer Bankruptcy Project.

5GAO Report (May 2015). Retirement Security: Most Households Approaching Retirement Have Low Savings, p. 11.

6GAO Report (June 2011). Retirement Income: Ensuring Income Throughout Retirement Requires Difficult Choices, p. 28.

7Assuming 2014 417(e) mortality.

8Interest rates have been very low in recent years and there has been legislative relief allowing for liabilities to be calculated at rates higher than actual market yield curves would require.